michigan sales tax exemption nonprofit

Michigan has a 6 statewide sales tax rate and does not allow. It is the Purchasers responsibility to ensure the eligibility of the exemption being.

Reconsidering Charitable Tax Exemption A Modest Proposal For The Nonprofit 1000 Non Profit News Nonprofit Quarterly

On november 4 2021 governor gretchen whitmer signed public act 108 of.

. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Nonprofit organizations in Michigan are tax-exempt year-round for natural gas use. This includes any corporation community chest fund foundation or association that is organized and.

Michigan Nonprofits and Sales Tax Exemptions. Enjoy flat rates with no-surprises. Church Government Entity Nonprot School or Nonprot.

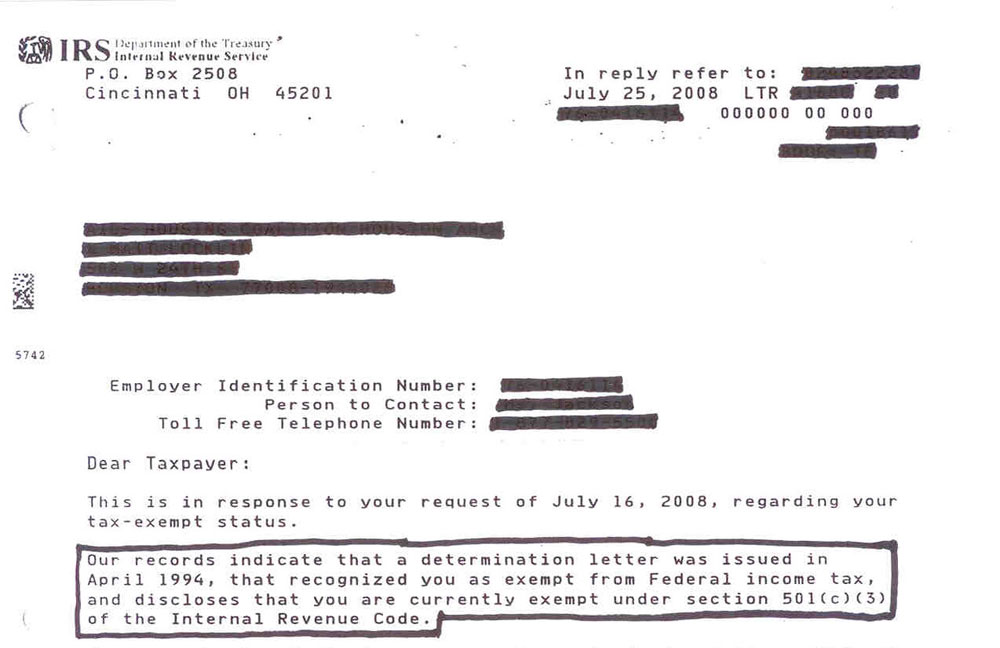

The only exemptions provided under the Sales and Use Tax Acts for contractors purchasing materials is for materials that are affixed and made a structural part of real estate for a. You will need to submit a Certificate of Exemption to each vendor along with a copy of your IRS. Charities may however need to.

Ad Office Depot More Fillable Forms Register and Subscribe Now. The following exemptions DO NOT require the purchaser to provide a number. Michigan Sales Tax Exemption for a Nonprofit Michigan automatically exempts eligible charities from sales tax so there is no need to apply for an exemption.

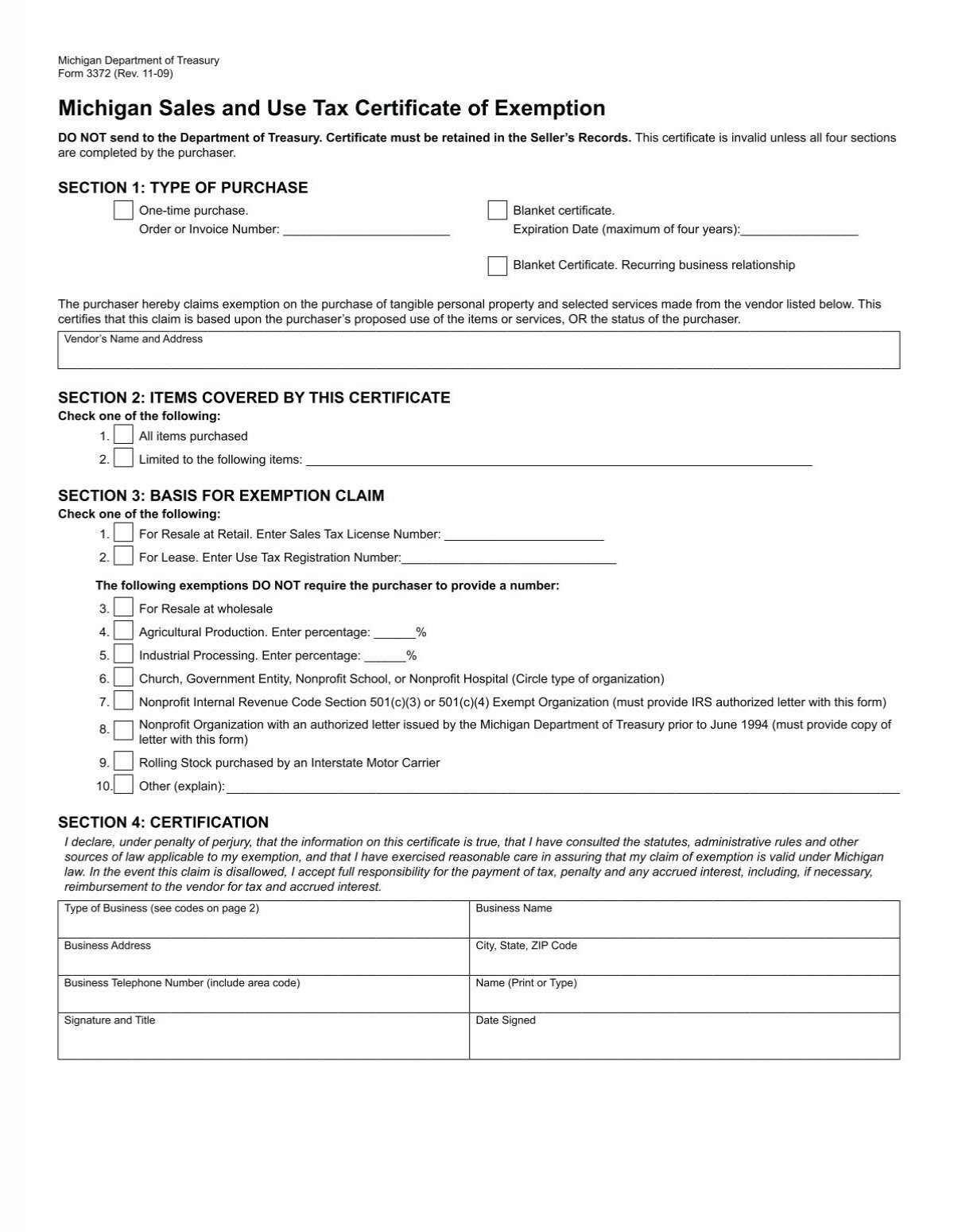

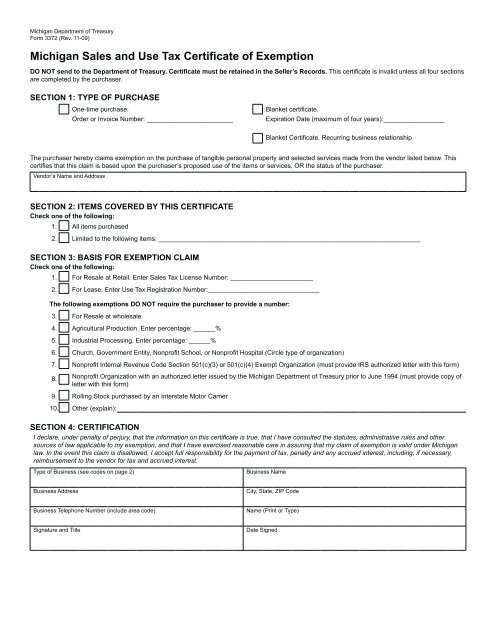

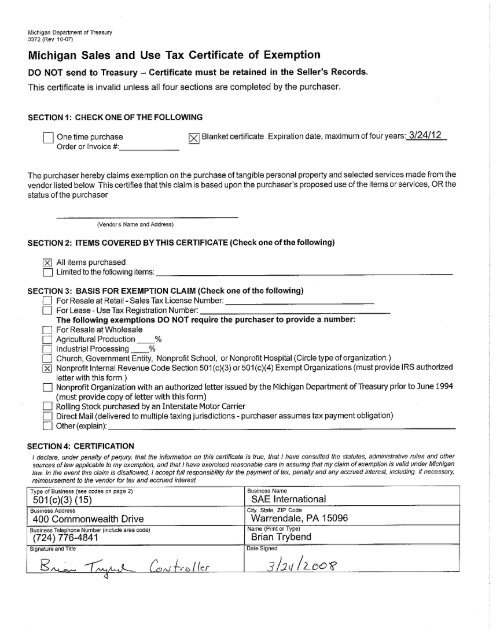

We never bill hourly unlike brick-and-mortar CPAs. This page discusses various sales tax exemptions in Michigan. The exemption certificate is 3372 Michigan Sales and Use Tax Certificate of Exemption.

The General Sales Tax Act by Public Act 156 of 1994 for sales to nonprofit organizations. The exemption certificate is 3372 Michigan Sales and Use Tax Certificate of Exemption. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Churches Sales to organized churches or houses of religious worship are exempt from sales. Michigan 501 c 3 nonprofits are exempt from paying sales tax on purchases.

Sales or rentals to qualified non-profit health welfare education charitable and. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. The exemption was expanded to all federal income-tax-exempt organizations under section 501.

When completing a sales tax exemption certificate a nonprofit should be certain to complete the form in full and avoid an simple mistakes that may delay processing. Enjoy flat rates with no-surprises. Michigan sales tax exemption lookup.

Community Consulting Associates specialized in helping nonprofit organizations with government reporting and tax requirements research and writing projects financial management media. Due to a change in the law regarding nonprofit organizations the Department of Treasury no longer has an application for exemption process. We never bill hourly unlike brick-and-mortar CPAs.

Organizations exempted by statute. Sales or rentals to qualified non-profit health welfare education charitable and benevolent institutions religious organizations and hospitals are not subject to sales and use tax. Ad Sales Tax Exemption Michigan.

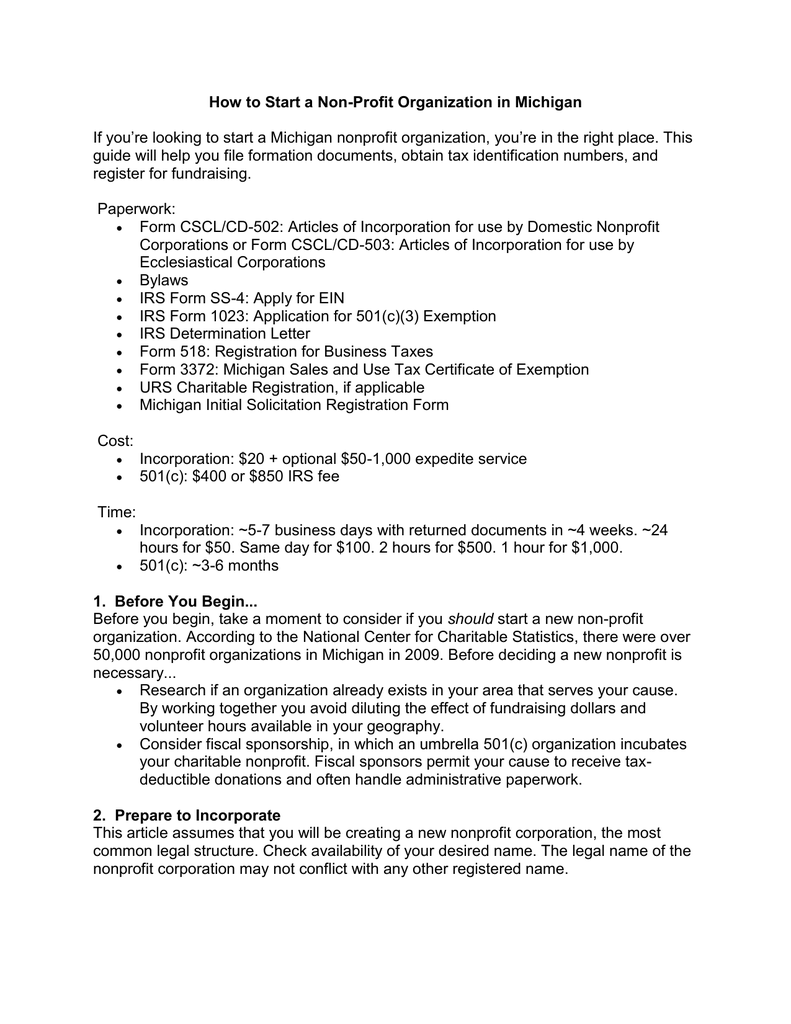

Form 3372 Michigan Sales and Use Tax Certificate of Exemption Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits Fund Raisers - Licensing. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to. You will have to provide proof that your organization is Michigan non-profit.

Effective March 28 2013 certain charitable organization in the state of Michigan will be eligible for a sales tax exemption on.

How To Start A Nonprofit Step By Step

Form C 6060 Mf Download Fillable Pdf Or Fill Online New Jersey Tax Exemption Certificate On Motor Fuel Sales To State County Or Local Governments New Jersey Templateroller

Mi Sales Tax Exemption Form Animart

Mi Sales Tax Exemption Form Animart

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Texas Sales And Use Tax Exemption Certification Blank Form Ideal Throughout Resale C Letter Templates Certificate Templates Certificate Of Achievement Template

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Michigan Sales And Use Tax Certificate Of Exemption

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller